|

My condolences if you have recently lost a loved one. Handling a decedent's estate during this COVID-19 pandemic has proven to be heartbreaking and extraordinarily time consuming.

As you may know, the New York State Surrogate's Courts are not currently accepting new filings as a result of Governor Andrew Cuomo's Stay at Home Order. What you may not know is that there are steps you can take now to get prepared for your probate or administration process. DISTRIBUTEES Whether your loved one left a Last Will & Testament or died intestate (without a Will), your petition must identify all living distributees (heirs) and provide an address for each one. Search for and make a written list of the names and addresses of ALL Distributees. Also make a copy of any marriage certificates, divorce decrees or birth certificates establishing your relationship to the deceased. ESTATE PROPERTY Any real property and personal property (financial accounts, stock, cooperative shares, automobiles, boats, corporate shares, business ownership, etc.) in the name of your loved one is considered estate property. Search for and make a written list detailing all real property and personal property. FUNERAL EXPENSES A certified copy of the death certificate and paid funeral bill must accompany your Surrogate's Court filing. Obtain a funeral bill stamped "PAID" and order at least 5 certified death certificates. POLICIES AND ACCOUNTS Any insurance policies, bank accounts, investment accounts or retirement accounts that do not have a beneficiary designation may become estate property. Search for insurance policies and statements from banks/investment companies/unions/retirement accounts. Take this time to provide a copy of the death certificate to each one. While this list is not meant to be exhaustive, it will give you a good start in preparing to handle your loved one's estate in the months ahead.

0 Comments

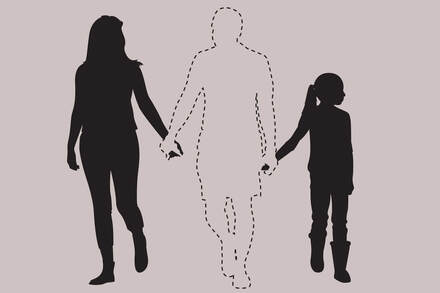

On November 25, 2019 New York Surrogate's Court Procedure Act section 1301 was amended raising the value of a small estate to $50,000.00. The Legislative justification is noted as follows: "In New York, it can be prohibitively expensive to administer a low-value estate, with attorney costs and court fees often costing thousands of dollars. Under NYS law, those administering "small estates" - estates with a gross value of $50,000 or less - have the ability to avoid these relative substantial monetary costs through a $1 "do-it-yourself" program (no lawyer, no fees, etc.) available through the court. However, this estate gross value cap was set nearly two decades ago and is no longer reflective of contemporary real estate and assets values of lower and middle-class people in New York; other states have subsequently raised their caps. By raising the cap to $50,000, this bill would both allow more lower and middle class New Yorkers access to this important program and put New York in line with contemporary state practices on this issue, such as California where a small estate is $150,000." APPROVED AND EFFECTIVE NOVEMBER 25, 2019 The New York Estates, Powers and Trusts Law carves out a portion of a decedent's estate to assist the surviving spouse or surviving children under 21 years old. The protective carve out is known as the "Family Exemption." Read More

"The court shall continue to exercise full and complete general jurisdiction in law and in equity to administer justice in all matters relating to estates and the affairs of decedents, and upon the return of any process to try and determine all questions, legal or equitable, arising between any or all of the parties to any action or proceeding, or between any party and any other person having any claim or interest therein, over whom jurisdiction has been obtained as to any and all matters necessary to be determined in order to make a full, equitable and complete disposition of the matter by such order or decree as justice requires." Surrogate's Court Procedure Act section 201.3. Read More

|

PLEASE TAKE NOTICE THAT reading of this blog does not in any way create or establish an attorney-client relationship between you and Tatia D. Barnes, Esq.

PLEASE TAKE NOTICE THAT the information provided on this blog are hypothetical scenarios, are provided for your general information, should not be relied on as legal advice and is not a substitute for direct consultation with an attorney about your specific legal situation or a legal question. |

|

Attorney Advertising. 2010 - 2024 All Rights Reserved |